Investment Strategy

Overview

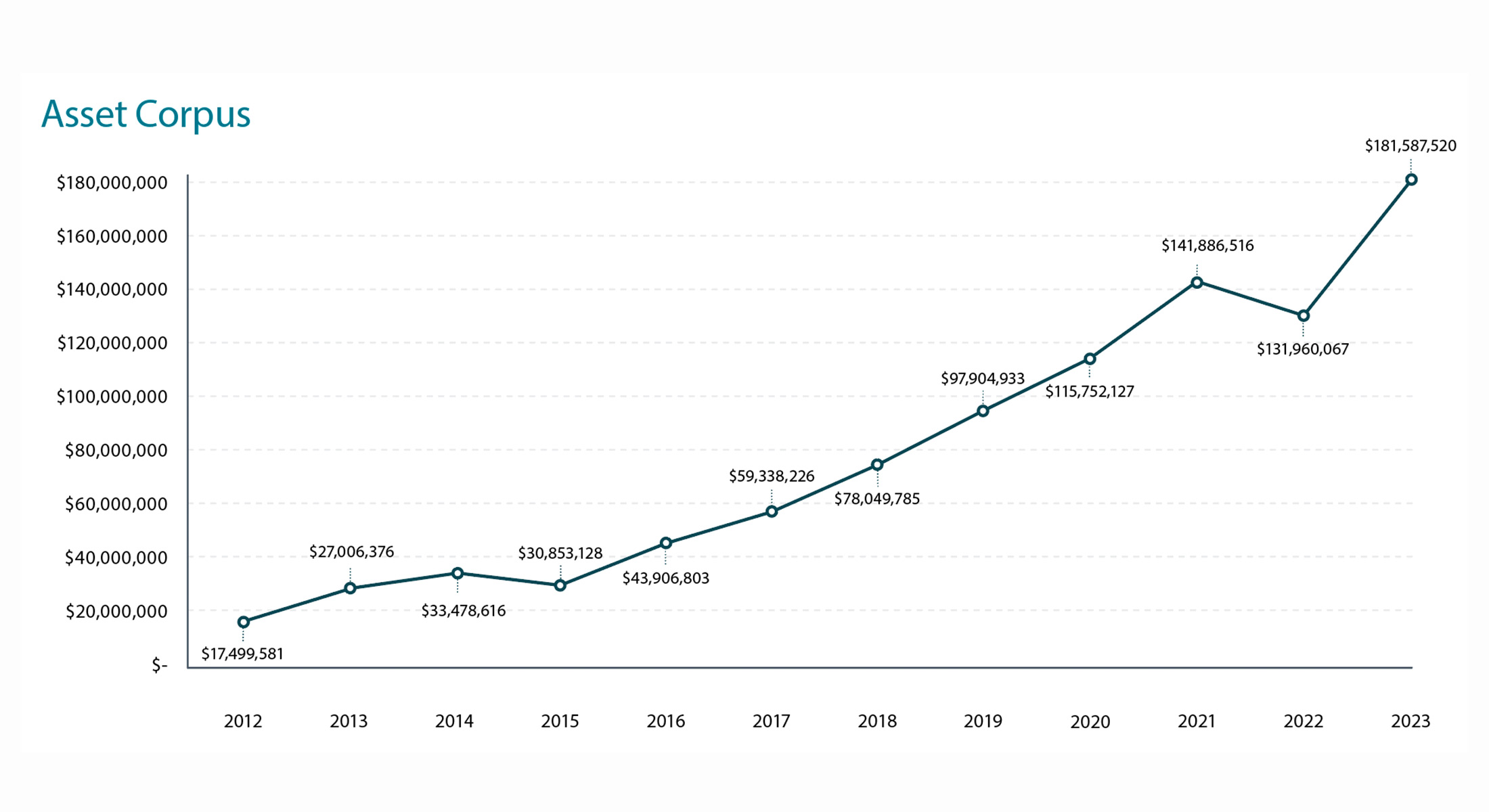

The Foundation’s corpus finished June 2023 at $181.6 million, year-on-year increase of $49.6m.

The Foundation’s corpus growth was driven by new investments and recovery of investment returns which had been affected by the global economy in the prior year.

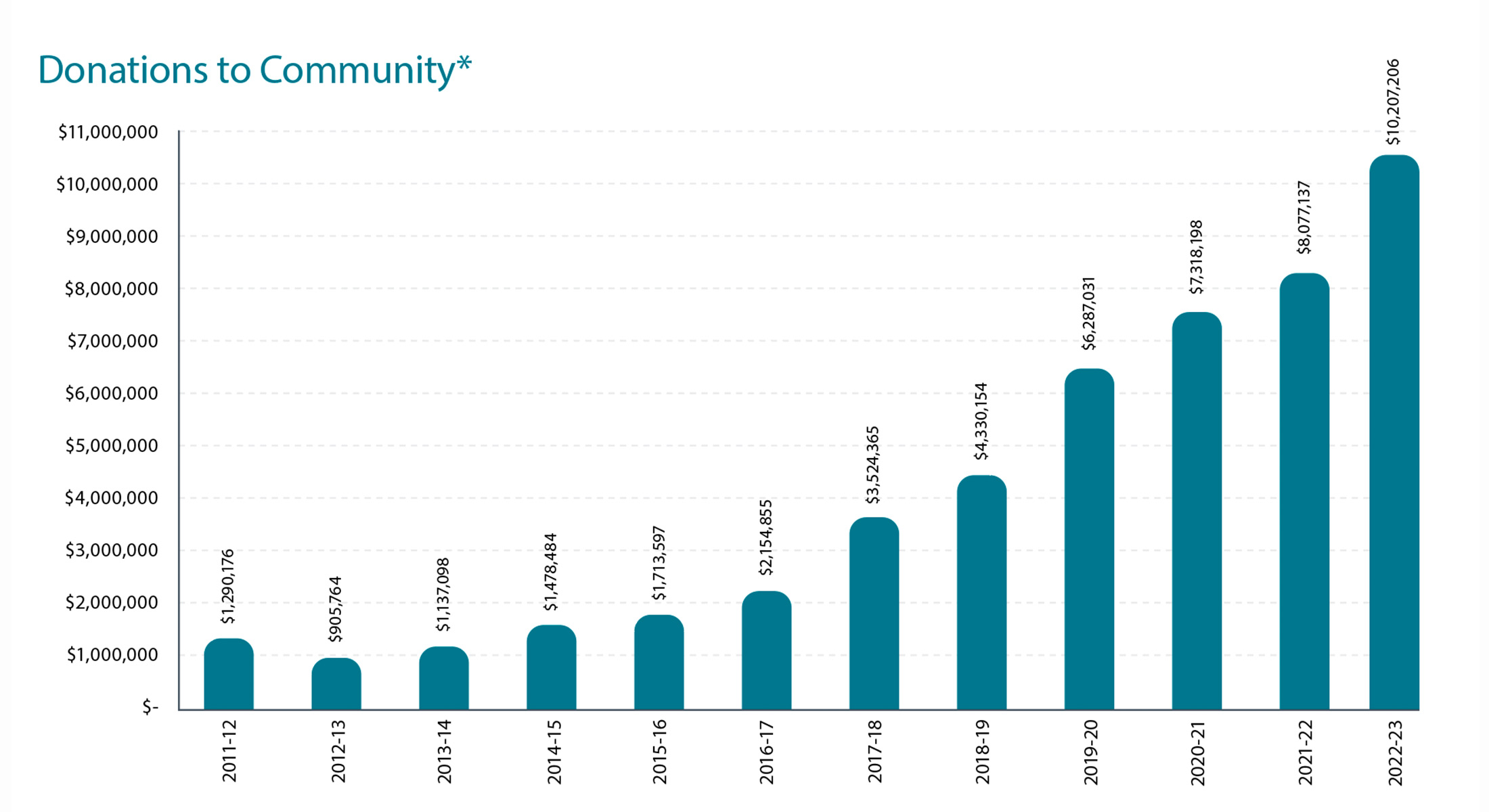

The Foundation continued its commitment to grow donations to the community year on year – from $8.1M in FY21/22 to $10.2M in FY22/23, with an additional $1.2m given to Canberra Grammar School. The corpus and annual donations are forecast to continue to grow in FY23/24, due to investment returns and additional contributions.

*excludes donations to Canberra Grammar School

Investment strategy

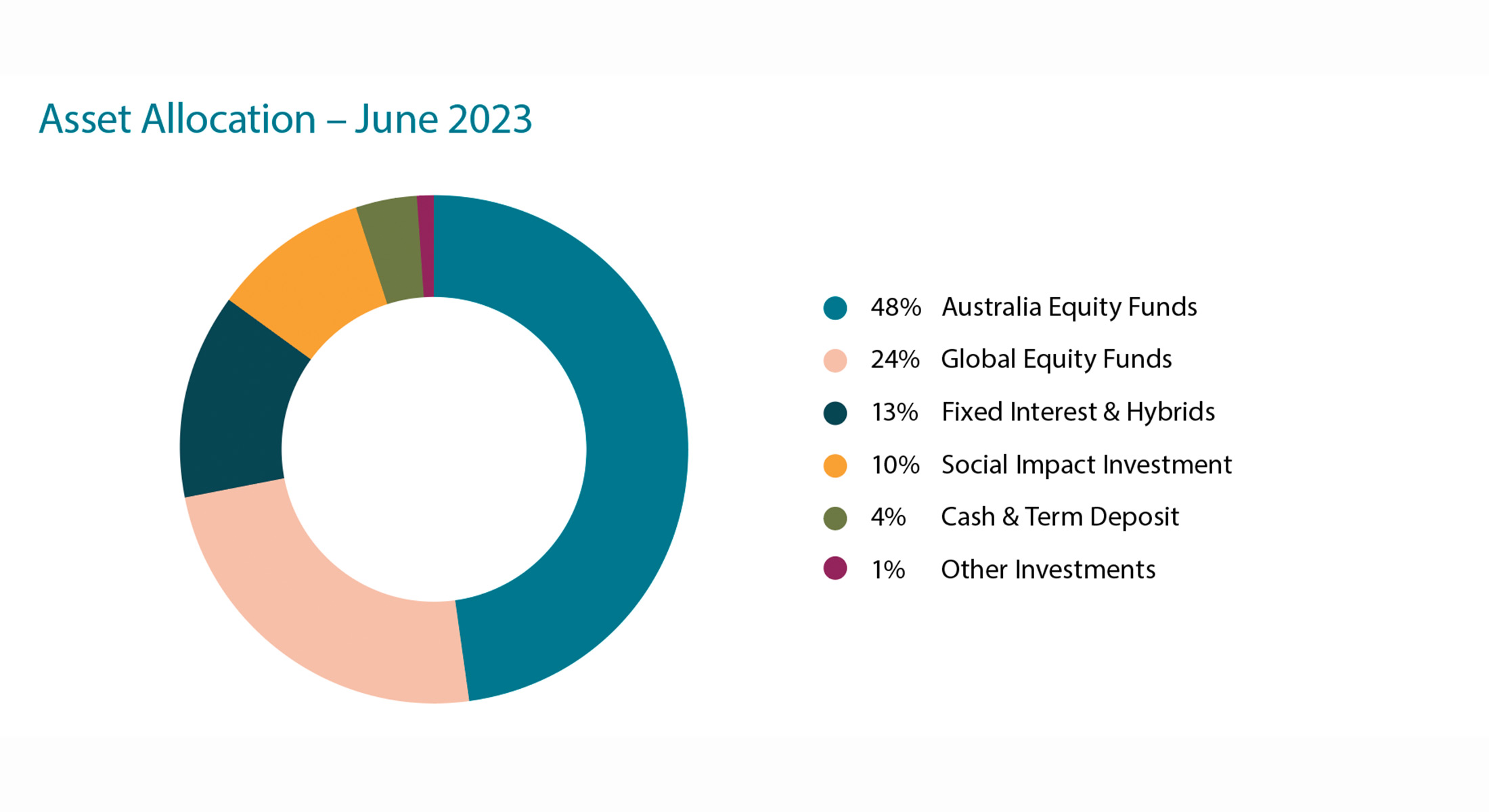

Our investment strategy is to ensure a strong rate of return to fund the Foundation’s grant-making programs over the long term, with a target-balanced asset portfolio skewed towards Australian shares, with fully franked yields offering additional returns without risk. We invest responsibly in corporations that reflect our mission, with preference given to members of ESG Research Australia and signatories to the United Nations PR.

Australian Equity Fund Managers

-

Future Generation Investment Company,

-

Third Link Growth Fund,

-

Hyperion Australian Growth Companies Fund,

-

Warakirri Equities Trust,

-

Warakirri Cash Trust,

-

Australian Foundation Investment Company,

-

BKI Investment Company,

-

Russell Investments Australia Responsible Investment,

-

Fair Betashares,

-

Plato Australia.

Social Impact investments

-

More than thirty social impact investments

Global Equity Fund Managers

-

Hyperion Global Growth Companies Fund,

-

Platinum International,

-

Future Generation Global Fund.