Investment Strategy

Overview

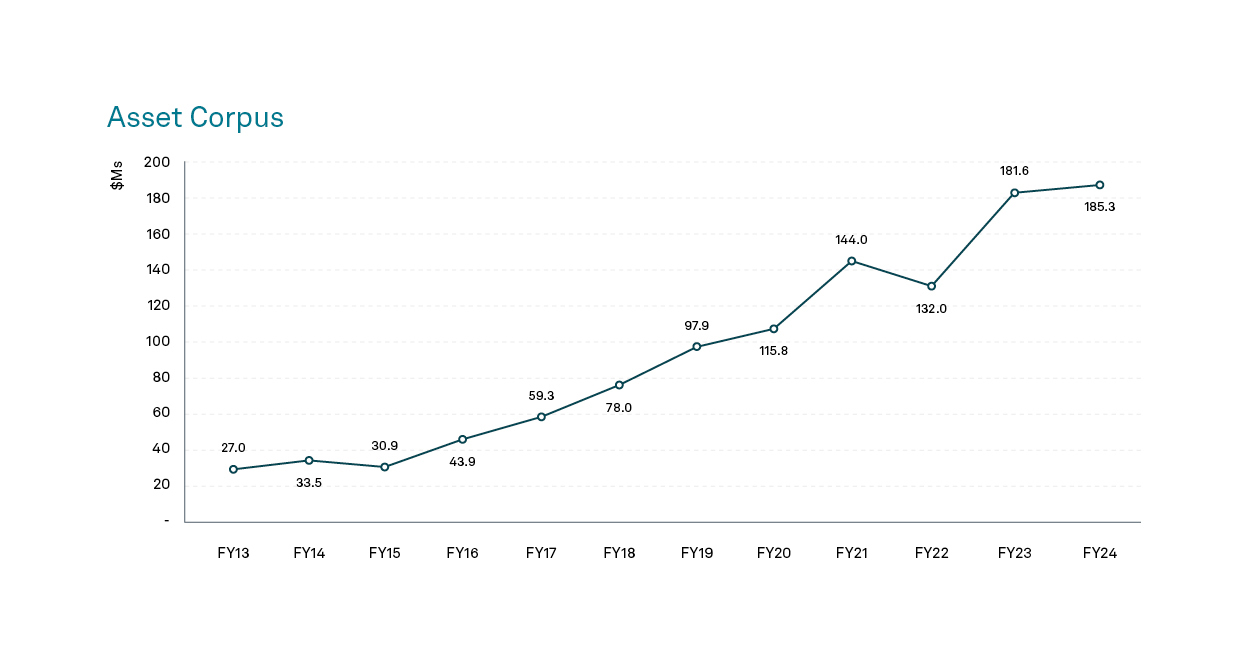

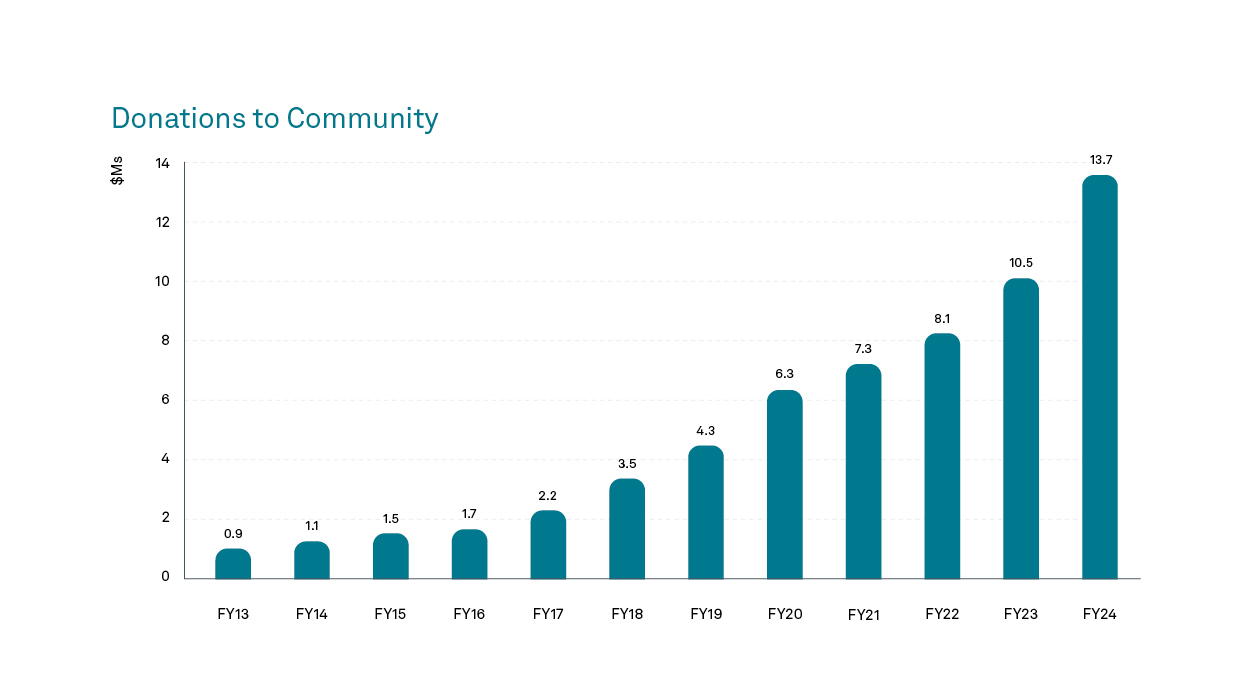

The Foundation’s corpus finished June 2024 at $185.3M and donations grew significantly to $13.7M.

Following the previous year’s rapid increase, corpus growth steadied this year and donations grew substantially from $10.5M to $13.7M. Looking ahead, the corpus and donations are forecast to grow.

Investment strategy

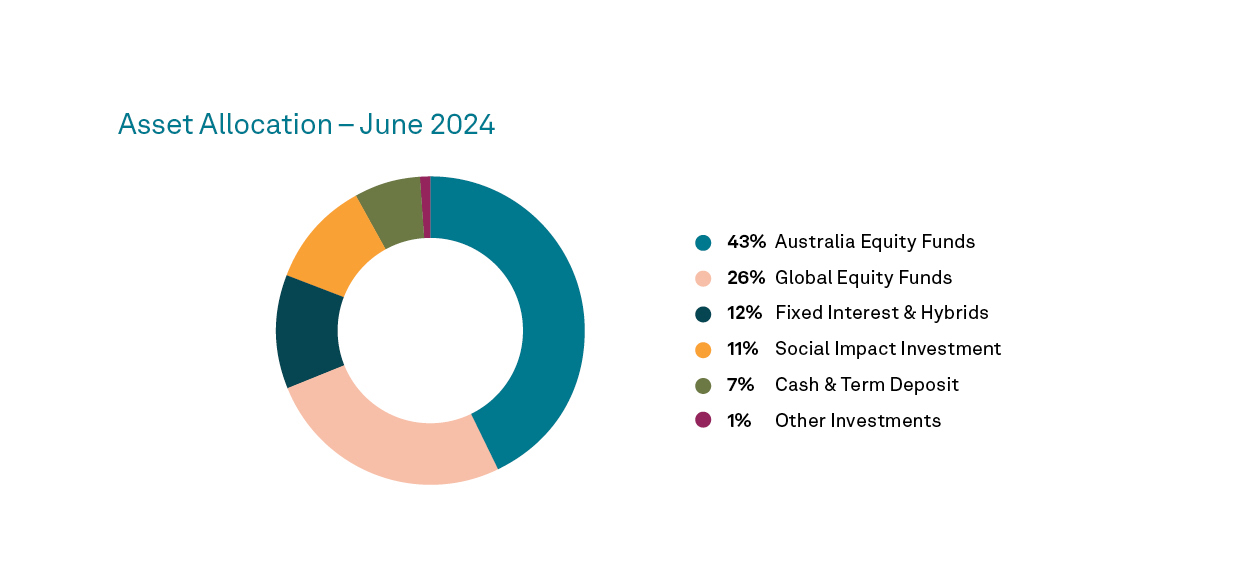

Our investment strategy aims to achieve a strong rate of return to fund the Foundation’s grant-making programs over the long term. The target-balanced asset portfolio is skewed towards Australian shares, which provide fully franked yields offering additional returns without increased risk. We invest responsibly in corporations that reflect our mission, with preference given to members of ESG Research Australia and signatories to the United Nations PRI.

Australian Equity Fund Managers

-

Future Generation Investment Company

-

Third Link Growth Fund

-

Hyperion Australian Growth Companies Fund

-

Warakirri Equities Trust

-

Warakirri Cash Trust

-

Australian Foundation Investment Company

-

BKI Investment Company

-

Russell Investments Australia Responsible Investment

-

Fair Betashares

-

Plato Australia

-

Fifth Estate Emerging Companies Fund II

Social Impact investments

-

Thirty-six social impact investments, as detailed over the page.

Global Equity Fund Managers

-

Hyperion Global Growth Companies Fund

-

Platinum International

-

Future Generation Global Fund

-

Vanguard Ethically Conscious ETF